Travelling in Asia offers incredible diversity, adventure and culture but managing your finances on the go can sometimes be tricky. With varying currencies and fees, keeping track of your money while travelling can make or break your experience. Thankfully, global money transfer apps and e-wallets have made it easier to navigate different financial systems, allowing travellers to spend more time exploring and less time worrying about money.

Let’s take a look at some of the most popular payment apps used by travellers in Asia, highlighting their unique features and why they are a must-have for your journey.

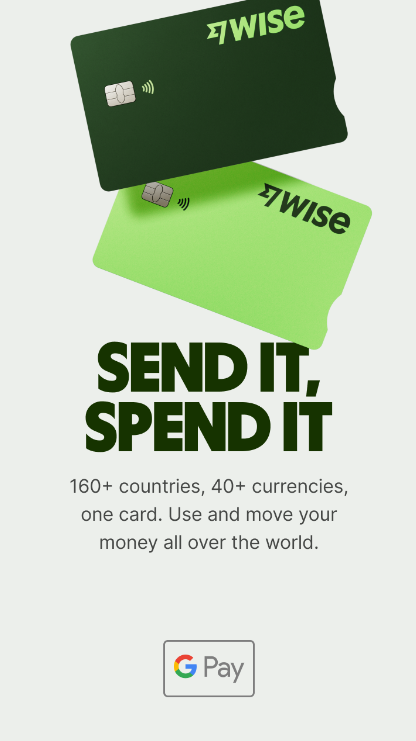

1. Wise

Wise is a global favourite for transferring money across borders at real mid-market exchange rates. It eliminates hidden fees, making it a go-to app for frequent travellers. You can hold balances in multiple currencies and easily transfer between them whenever you need.

- Best feature: Real-time exchange rates with low fees and no hidden costs.

- Why travellers love it: Wise is perfect for those visiting multiple Asian countries as it supports many local currencies. Its transparent fee structure and low-cost international transfers is a game-changer for budget-conscious travellers.

- Used widely in: Malaysia, Singapore, Thailand and Indonesia.

- Notable speciality: Wise’s multi-currency account lets travellers hold, exchange, and spend in different currencies using a debit card. Get the card by paying a one-time fee of around RM13.70.

Example of how to convert JPY to MYR using Wise:

- Open the Wise app and select your JPY balance (or add JPY to your account if you haven’t already).

- Choose to convert JPY into MYR.

- The app will show you the current mid-market exchange rate (e.g. 1 JPY = 0.03 MYR) in real-time, ensuring you get the best possible rate without hidden markups.

- Input the amount of JPY you want to convert. For example, if you convert 10,000 JPY to MYR, Wise will show you the exact amount of MYR you’ll receive after a small conversion fee (e.g 10,000 JPY may convert to 304.50 MYR after fees).

- Complete the transaction, and the MYR will be added to your Wise account within seconds.

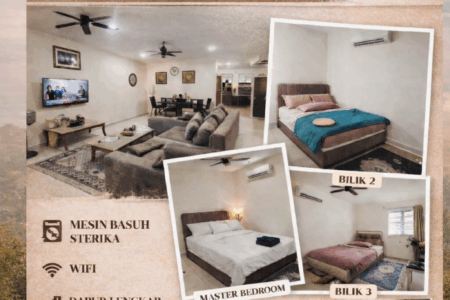

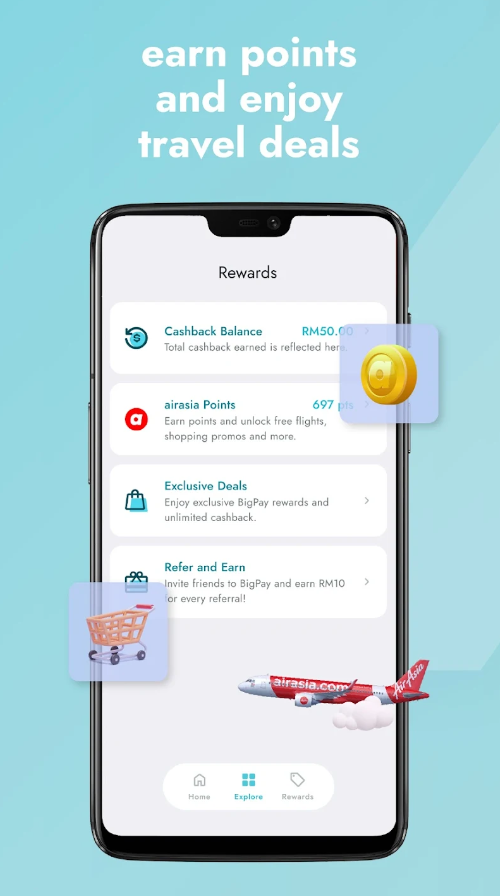

2. BigPay

BigPay is a Malaysia-based e-wallet that allows users to transfer money abroad, spend in different currencies and enjoy benefits such as airline promotions. It’s widely used in Southeast Asia and offers seamless integration with your everyday spending.

- Best feature: Low-cost money transfers and fee-free spending in multiple currencies.

- Why travellers love it: Its low fees and competitive exchange rates make it a great choice for budget travellers. Plus, the BigPay card can be used anywhere that accepts Mastercard, making it very convenient.

- Used widely in: Malaysia, Thailand, Indonesia and Singapore.

- Notable speciality: Offers discounted flights and rewards for Airasia.

3. Alipay

Alipay is China’s leading e-wallet and is widely accepted across Asia for digital payments. It allows users to make smooth transactions for shopping, transportation and travel bookings, all through one app.

- Best feature: Contactless payments and integration with various services, including travel, shopping and dining.

- Why travellers love it: Alipay is the go-to e-wallet for tourists visiting China and other parts of Asia. Its ability to pay for almost anything—from taxis to street food vendors—without carrying cash is a major plus for international travellers.

- Used widely in: China, Hong Kong and increasingly across Southeast Asia.

- Notable speciality: Offers an easy-to-use “Tour Pass” feature for foreign visitors, allowing them to top up their wallet with an international credit or debit card and use it seamlessly during their stay in China.

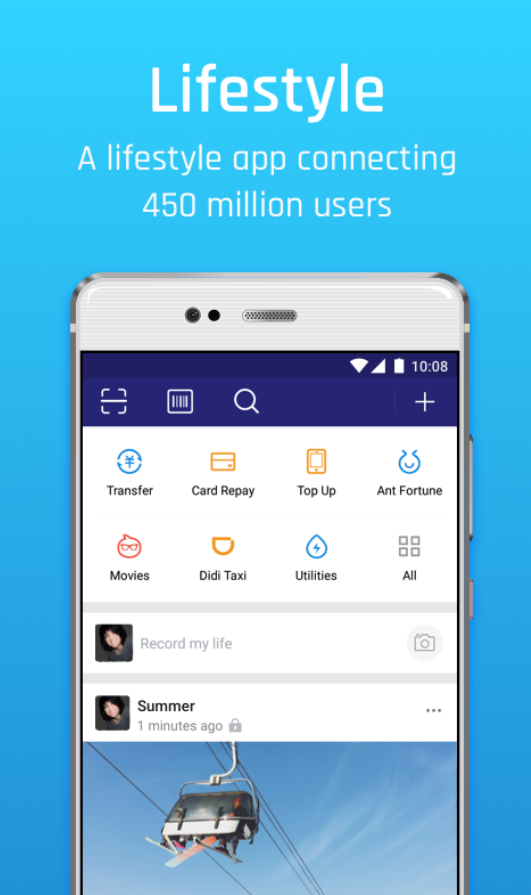

4. WeChat Pay

WeChat Pay is part of the WeChat ecosystem combining social media, messaging and payment services. It’s incredibly popular in China and is expanding its reach into Southeast Asia. Travellers can use it to pay for services, send money and book tickets for various attractions.

- Best feature: Stay connected with your contacts and make payments all in one app.

- Why travellers love it: The convenience of making payments directly through an app they’re already using for messaging is a significant advantage for travellers. The ability to pay for goods and services without cash makes it particularly helpful in China.

- Used widely in: China, Hong Kong and parts of Southeast Asia.

- Notable speciality: WeChat Pay’s integration with other WeChat features offers a seamless experience for users who want all-in-one convenience.

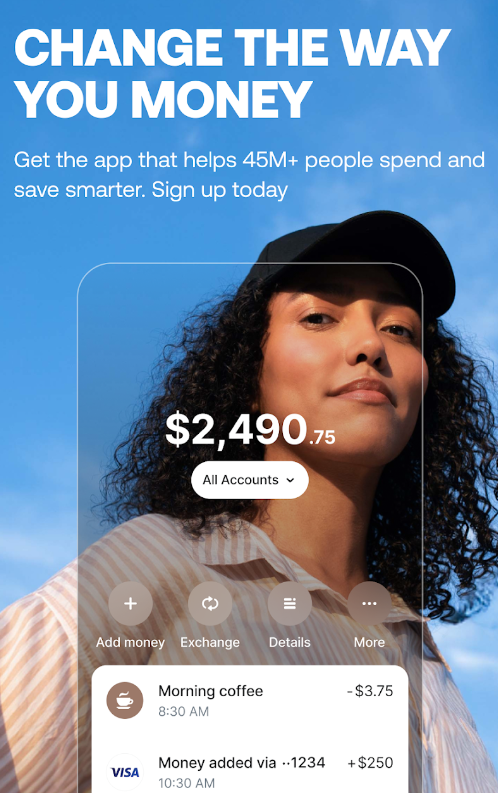

5. Revolut

Revolut offers a wide range of financial services, including global money transfers, currency exchange and real-time spending analytics. Its ease of use and ability to hold multiple currencies make it a strong competitor for international travellers.

- Best feature: No-fee international spending and built-in budgeting tools.

- Why travellers love it: Fee-free ATM withdrawals up to a limit, free international transactions and the ability to spend in multiple currencies without worrying about conversion rates.

- Used widely in: Japan, South Korea and Singapore.

- Notable speciality: Revolut’s smart budgeting tool helps travellers track their expenses in real-time, which is a valuable feature when travelling across different countries.

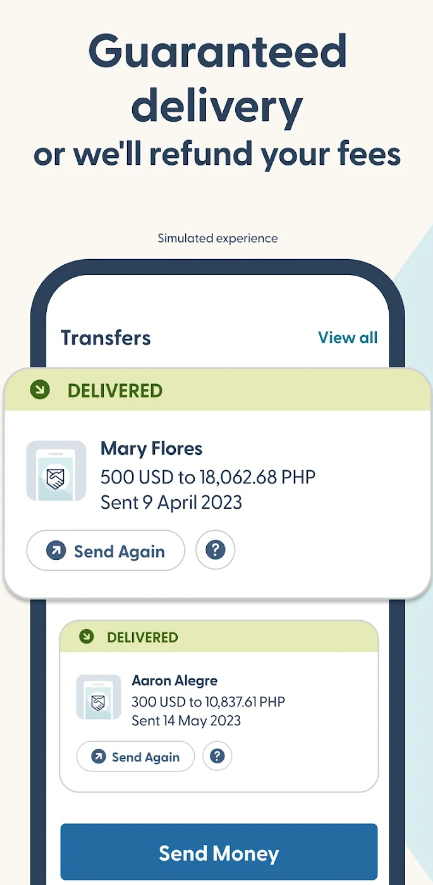

6. Remitly

Remitly provides fast, affordable international money transfers, with a focus on developing countries. You can send money quickly to bank accounts, mobile wallets or cash pickup at various partner locations across Asia.

- Best feature: Speedy transfers with multiple payout options (cash pickup, e-wallet or bank transfer).

- Why travellers love it: Its speed and flexible options for receiving money make it a favourite for those needing to send or receive money on short notice. With the option to track transfers in real-time, it’s a trusted tool for both travellers and expats.

- Used widely in: The Philippines, Vietnam, India and Indonesia.

- Notable speciality: Its ability to send money to cash pickup locations is especially useful in remote areas, where traditional banking services might not be available.

Having the right money transfer app or e-wallet can make all the difference when travelling through Asia, ensuring your finances are handled smoothly no matter where you go. Whether it’s paying for a meal, booking a ride, or sending money to friends, these tools make it easier to explore without worrying about currency exchanges and hidden fees.

At MyRehat, we are here to make your travel experience easier by offering tips, insights and accommodation solutions across Southeast Asia. Ready for your next trip? Visit www.myrehat.com for more travel content, tips and resources to ensure a seamless and enjoyable journey. Safe travels!